orient-interior.ru

Market

Where Will Interest Rates Be In 5 Years

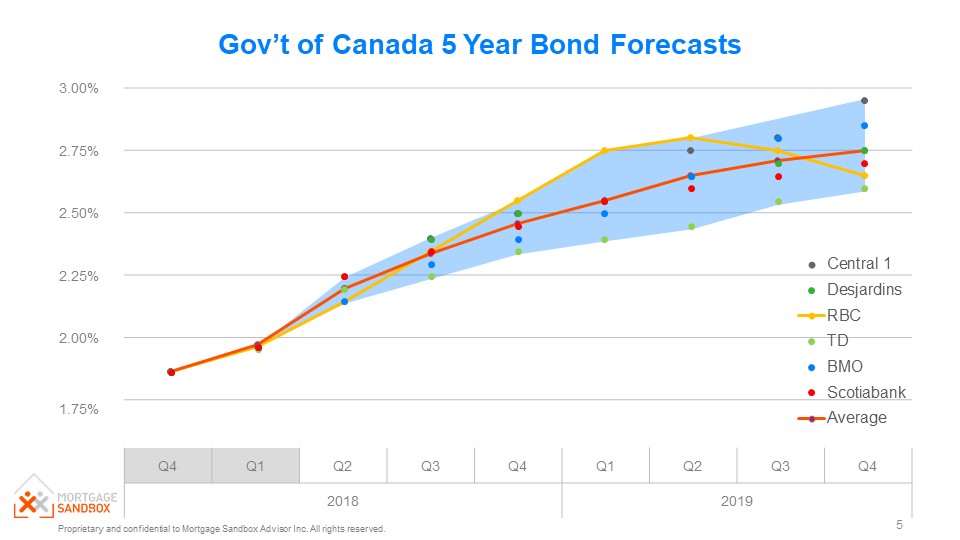

Still, the Fed does not expect it will be appropriate to reduce rates until Michigan 5 Year Inflation Expectations · Michigan Inflation Expectations. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment. Long-term interest rates forecast refers to projected values of government bonds maturing in ten years. It is measured as a percentage. Say a bond with a $1, face value pays 5% interest annually ($50 per year) at a fixed interest rate. The only way somebody would buy the 5% bond would be at. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of The inflation-indexed constant maturity yields are read from this yield curve at fixed maturities, currently 5, 7, 10, 20, and 30 years. Back to Top. Last. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. For now, that leaves the central bank's benchmark interest rate between % and %, where it has remained since July , and which marks its highest. Still, the Fed does not expect it will be appropriate to reduce rates until Michigan 5 Year Inflation Expectations · Michigan Inflation Expectations. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment. Long-term interest rates forecast refers to projected values of government bonds maturing in ten years. It is measured as a percentage. Say a bond with a $1, face value pays 5% interest annually ($50 per year) at a fixed interest rate. The only way somebody would buy the 5% bond would be at. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of The inflation-indexed constant maturity yields are read from this yield curve at fixed maturities, currently 5, 7, 10, 20, and 30 years. Back to Top. Last. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. For now, that leaves the central bank's benchmark interest rate between % and %, where it has remained since July , and which marks its highest.

Over the first 5 years, an interest rate of % costs $29, more than When you're ready to get serious about buying, the best thing you can do to get a. However, you will need to own the home for at least 5 years before selling or refinancing at a lower rate to recover the costs. Temporary Mortgage Buy-Downs. “Economists predict that mortgage rates will remain elevated for most of and that they will only begin to fall once the Federal Reserve starts cutting. What will be US interest rates in 5 years? And how do they influence cryptocurrencies? Projections and FOMC view on the economy explained. The US Federal Reserve (Fed) has raised interest rates by another 25 basis points (bps) at the May meeting, bringing the rate to between 5% and %, the. The Federal Reserve hasn't changed rates since July but experts believe a cut is likely in September. The spread between the rate on the main refinancing operations and the deposit facility rate will be reduced to 15 basis points. The rate on the marginal. The interest rate projections for the Next Five years are different, as per different sources. Trading Economics: 5% in , % in , and % in Remaining loan balances are at the Taxable interest rate. 5 Balloon programs feature fixed terms of 7 or 10 years with year amortizations. Additional rate. Year mortgage rate forecast for January Maximum interest rate %, minimum %. The average for the month %. The mortgage rate forecast at the. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct. 26, according. You know the fixed rate of interest that you will get for your bond when you buy the bond. Note: For bonds less than 5 years old, values shown in. Date Range (Record Date): Jul 1 Year 5 Years 10 Years All Custom. Data Table: Average Interest Rates on U.S. Treasury Securities. Date Range: 08/01/ Interest rates have shot up across the board. Now, the best CD rates hover around 5% APY for terms ranging from six months to a year, but these rates are. 29 as markets became increasingly convinced that the Federal Reserve will cut short-term interest rates in mid-September. The year fixed-rate mortgage. Here's a quick look at what the experts are saying when it comes to interest rates in and the coming 5 years. Year mortgage rate forecast for January Maximum interest rate %, minimum %. The average for the month %. The mortgage rate forecast at the. How do 15‑ or 30‑year fixed mortgage rates compare to adjustable rates? With fixed‑rate mortgages, the interest rate remains the same for the entire term of the. You have $1, invested in a 5-year TIPS with an interest rate of %. You will get an interest payment next week and want to know how much it will be.

What Is Margin Investing

Thus, the only time margin makes sense is if you make more of a profit percentage from investing the loaned money (say you make 10% profit) than. Margin rates help determine how much traders will pay to use margin, and can help inform investing decisions. Margin trading is a more advanced investing. Margin investing allows you to have more assets available in your account to buy marginable securities. A margin account is much like a cash investment account. You can deposit any amount of money to invest in the market. To apply for margin, download a Margin Agreement Form and an Update/Change of Client Information Form. Once completed, drop off your forms at any RBC Royal Bank. Margin trading refers to the practice of using borrowed money from a broker to invest. The term “margin” refers to the amount deposited with a brokerage when. With margin trading, you borrow cash from your brokerage to buy securities. You also pay margin interest on the loan. With short selling, you borrow securities. Margin trading, which is also referred to as buying investments on margin or margin investing, has to do with how you trade, not what you trade. A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Trading on margin magnifies gains and losses. Thus, the only time margin makes sense is if you make more of a profit percentage from investing the loaned money (say you make 10% profit) than. Margin rates help determine how much traders will pay to use margin, and can help inform investing decisions. Margin trading is a more advanced investing. Margin investing allows you to have more assets available in your account to buy marginable securities. A margin account is much like a cash investment account. You can deposit any amount of money to invest in the market. To apply for margin, download a Margin Agreement Form and an Update/Change of Client Information Form. Once completed, drop off your forms at any RBC Royal Bank. Margin trading refers to the practice of using borrowed money from a broker to invest. The term “margin” refers to the amount deposited with a brokerage when. With margin trading, you borrow cash from your brokerage to buy securities. You also pay margin interest on the loan. With short selling, you borrow securities. Margin trading, which is also referred to as buying investments on margin or margin investing, has to do with how you trade, not what you trade. A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Trading on margin magnifies gains and losses.

Margin is used by different types of traders and investors in different ways. Trading on margin (aka trading with leverage) can help traders juice their buying. Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both for the good and the bad. A margin account can help you get a step ahead. This type of account allows you to borrow from your portfolio so you can get cash to seize other opportunities. Margin trading refers to borrowing money from a broker to purchase equity shares and securities. Investors can also buy more stock than they could once they. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. Margin lending is a type of loan that allows you to borrow money to invest, by using your existing shares, managed funds and/or cash as security. A margin account is much like a cash investment account. You can deposit any amount of money to invest in the market. Margin trading is when you put down a deposit to open a position with a much larger market exposure. Your broker will then credit your account with the full. When you invest on margin, you borrow either cash or securities from Vanguard Brokerage. (Vanguard) to complete investment transactions. You're usually required. Margin trading is when you pay only a certain percentage, or margin, of your investment cost, while borrowing the rest of the money you need from your broker. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit. Securities margin refers to borrowing money to purchase stock. However, commodities margin involves putting in your own cash as collateral for the contract. Learn how you can use margin to buy securities and diversify your portfolio with your Merrill Edge Self-Directed account. A margin loan from Fidelity is interest-bearing and can be used to gain access to funds for a variety of needs that cover both investment and non-investment. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more. Margin increases investors' purchasing power, but also exposes investors to the potential for larger losses. Learn More. Margin trading is the act of borrowing funds from a broker with the aim of investing in financial securities. The purchased stock serves as collateral for the. In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty to cover some or all of the credit risk the. Margin is a convenient source of liquidity to pursue investment opportunities or to meet other personal or business financing goals. Margin is a loan from Wells. Buying on margin is a trading strategy that involves borrowing money from a brokerage to purchase investment assets (usually a security like stocks or.

What Does Strike Price Mean

Key Takeaways: · The strike price of an option is the price at which a put or call option can be exercised. · A relatively conservative investor might opt for a. The position limit for Crypto Strike Options is 25, This means you can have a maximum of 25, open positions for BTC and 25, for ETH at the same time. A strike price is the only basis for exercising an options contract—not the underlying asset's market price. Below we'll discuss strike options, the types of. If the stock's market price rises above the strike price, the option is considered to be “in the money.” An in the money call option has “intrinsic value”. It is the price at which the option contract is exercised. The strike price meaning is different from the spot price, which is the current ruling price of the. Spot price means the current market price. In short: spot price = now, while strike price = when exercising. On this page: Option Spot. The strike price is the price at which an option can be exercised by its holder (owner). For call options, the strike price is the price at which an underlying stock can be bought. For put options, the strike price is the price at which shares can. The strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on whether they hold a. Key Takeaways: · The strike price of an option is the price at which a put or call option can be exercised. · A relatively conservative investor might opt for a. The position limit for Crypto Strike Options is 25, This means you can have a maximum of 25, open positions for BTC and 25, for ETH at the same time. A strike price is the only basis for exercising an options contract—not the underlying asset's market price. Below we'll discuss strike options, the types of. If the stock's market price rises above the strike price, the option is considered to be “in the money.” An in the money call option has “intrinsic value”. It is the price at which the option contract is exercised. The strike price meaning is different from the spot price, which is the current ruling price of the. Spot price means the current market price. In short: spot price = now, while strike price = when exercising. On this page: Option Spot. The strike price is the price at which an option can be exercised by its holder (owner). For call options, the strike price is the price at which an underlying stock can be bought. For put options, the strike price is the price at which shares can. The strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on whether they hold a.

What Is a Strike Price? An option constitutes a contractual agreement to either purchase or sell an asset at a predefined price prior to a designated date. What is a strike price? Options trading, on the other hand, is a popular trade strategy that, like other investments, needs adequate preparation and prior. Strike price options are defined as the price at which the holder of options can buy (in the case of a call option) or sell (in the case of a put option). Strike Price Definition: The strike price of an option is the price at which the option buyer has the right to buy or sell an underlying. In finance, the strike price (or exercise price) of an option is a fixed price at which the owner of the option can buy (in the case of a call), or sell (in. Strike price – This is the price at which you can buy or sell the shares. Option type – This letter, either a "C" or "P", indicates whether it is a call or a. A strike price is a theoretical market price used in options trading. In put and call options trading, the strike price is the price at which a security can be. The position limit for Crypto Strike Options is 25, This means you can have a maximum of 25, open positions for BTC and 25, for ETH at the same time. If an investor owns a stock they do not want to sell and chooses to sell covered calls, there are 2 prudent guidelines. First, the strike price of the call. Definition: Strike price is the pre-determined price at which the buyer and seller of an option agree on a contract or exercise a valid and unexpired option. An option's strike price definition is the pre-agreed price at which an underlying security can be bought (a call option) or sold (a put option) by the option. Referred to as the exercise price as well, the strike price is the predetermined value at which a specific security can be bought (in the case of a call option). A call option is in-the-money when the underlying security's price is higher than the strike price. For illustrative purposes only. Intrinsic Value (Puts). A. The strike price or exercise price is how much an employee will pay to exercise one share of your company's stock. The strike price is determined by the Fair. Understand the options strike price, the predetermined price at which you buy or sell an underlying futures contract. Strike price options are defined as the price at which the holder of options can buy (in the case of a call option) or sell (in the case of a put option). With options and warrants, the strike price is the price at which the right to purchase or sale an option can be exercised. At this price, the underlying be. A strike price is the price in an options contract at which the underlying asset can be bought or sold. Explore the markets with our free course · When you buy a call option, you have the right to buy an underlying market at the strike price before a set expiry.

Top Indicators For Day Trading

The best day trading indicators are price action and volume because they are instant. Moving average lines, rsi, macd are helpful but lagging. Forex Day Trading Best Indicators – Case Study · Murrey levels · Average directional index · 9. Standard deviation · 8. Ichimoku cloud · 7. Fibonacci. Popular technical indicators include simple moving averages (SMAs), exponential moving averages (EMAs), bollinger bands, stochastics, and on-balance volume (OBV). Best trading indicators · Moving average (MA) · Exponential moving average (EMA) · Stochastic oscillator · Moving average convergence divergence (MACD) · Bollinger. The #1 indicator for daytrading is VOLUME!! This can't be emphasized enough. WITH volume I use a combo of the SMA (5), SMA (20), RSI and my. There are two main categories of trading indicators used in trading: overlays (e.g., Bollinger Bands, Moving Averages) that are directly plotted on price charts. We will explain what technical indicators are all about and the top 6 indicators you must know how to use if you want to tread the path of other successful day. Which is the best indicator for intraday trading? · Moving average · Bollinger Bands · Momentum Oscillator · Relative Strength Index (RSI). The best technical indicators for day trading are the RSI, Williams Percent Range, and MACD. These measurements show overbought and oversold levels on a chart. The best day trading indicators are price action and volume because they are instant. Moving average lines, rsi, macd are helpful but lagging. Forex Day Trading Best Indicators – Case Study · Murrey levels · Average directional index · 9. Standard deviation · 8. Ichimoku cloud · 7. Fibonacci. Popular technical indicators include simple moving averages (SMAs), exponential moving averages (EMAs), bollinger bands, stochastics, and on-balance volume (OBV). Best trading indicators · Moving average (MA) · Exponential moving average (EMA) · Stochastic oscillator · Moving average convergence divergence (MACD) · Bollinger. The #1 indicator for daytrading is VOLUME!! This can't be emphasized enough. WITH volume I use a combo of the SMA (5), SMA (20), RSI and my. There are two main categories of trading indicators used in trading: overlays (e.g., Bollinger Bands, Moving Averages) that are directly plotted on price charts. We will explain what technical indicators are all about and the top 6 indicators you must know how to use if you want to tread the path of other successful day. Which is the best indicator for intraday trading? · Moving average · Bollinger Bands · Momentum Oscillator · Relative Strength Index (RSI). The best technical indicators for day trading are the RSI, Williams Percent Range, and MACD. These measurements show overbought and oversold levels on a chart.

Discover the Best Forex Indicators for a Simple Strategy · Moving Average · RSI (Relative Strength Index) · Slow Stochastic · MACD. Commodity Channel Index, Relative Strength Index, and Bollinger Bands are some of the technical indicators that you can use when day trading. You can also use. The best day trading indicators in my opinion and that I use daily are EMA lines and the MACD. Don't just use it aimlessly like an archer and then decide you. 10 top trading indicators · 1. Moving averages · 2. EMAs · 3. MACD · 4. RSI · 5. Stochastic oscillator · 6. Bollinger bands · 7. Pivot points. Top 5 Best Leading Indicators For Day Trading · 5. Ichimoku Indicator · 4. Awesome Oscillator · 3. On Balance Volume (OBV) · 2. Fibonacci Retracements · 1. Best Technical Indicators for Day Trading · VWAP · Moving Averages · Momentum Oscillators · MACD. MACD, or moving average convergence divergence, is another. Examples of such indicators include Volume Weighted Average Price (VWAP), moving averages, Bollinger Bands, and Relative Strength Index (RSI). Best intraday trading indicators · 1. Moving Averages: · 2. Bollinger Bands: · 3. Momentum Oscillators: · 4. Relative Strength Index (RSI): · 5. Moving Average. So how would we use the RSI indicator? Well in essence, to help us spot if a stock is overbought (in which case it's ready for a price correction), or that it's. The most practical signal for scalpers and day traders would be a divergence between the main candlestick chart and the MACD. Such a divergence most often. The most widely used indicator is the simple moving average. More specifically the 20MA and 50MA on the 15 and 30 min, and to a lesser extent. Today I want to talk to you about 7 trading indicators that you can use in your chart and technical analysis before you place a trade. 10 common trading indicators you can use · 1. Simple Moving Average (SMA) · 2. Exponential Moving Average (EMA) · 3. Moving Average Convergence Divergence (MACD). The most practical signal for scalpers and day traders would be a divergence between the main candlestick chart and the MACD. Such a divergence most often. The most widely used indicator is the simple moving average. More specifically the 20MA and 50MA on the 15 and 30 min, and to a lesser extent. A technical indicator can be defined as a tool that analyses historical data to forecast the future price movements of a stock. Stochastic is considered one of the top forex indicators that help traders identify momentum and overbought/oversold zones. In forex trading, the stochastic. We'll take a look at three categories of vital crude oil day trading indicators: fundamental, momentum oscillators, and support & resistance levels. The screenshot below shows a chart with 3 momentum indicators (MACD, RSI and the Stochastic). Essentially, all 3 indicators provide the same information because. Below you will find out more about the best trading indicators for futures trading that I use and that are great for all levels as they make things simple.

How To Delete Background In Lightroom

It's not possible to lighten the background in Lightroom without affecting everything else in the image and that will destroy the rest of the image. The remove background image tool in Adobe Express saved me hours of tedious editing, effortlessly removing backgrounds and refining my images with just a few. While you cannot replace, remove, or radically change the background in LR you can take advantage of the Adjustment Brush tool. Now you need to use a Lightroom adjustment brush tool to remove the shadows which are available on your photos. You could find the Brush tool option at the top. Detailed Guide to Remove Image Background · Step 1: Launch the HitPaw Photo Object Remover and click on the Remove Background icon. · Step 2: When you upload. If you want to get rid of shadows in Lightroom, start by making global adjustments to your image, and using sliders is the easiest way to do it. on the effect control panel, locate the effect and use the eye dropper tool the select the color you want to remove. once that is done, you'll. Get started · Sign up to orient-interior.ru to create a Kaleido account. · Go to Zapier to sign up for a new account, or sign in to your existing one. · On Zapier, connect. Import your image into Lightroom and navigate to the Develop module. · Locate the Spot Removal tool in the toolbar. · Click on Content-Aware. It's not possible to lighten the background in Lightroom without affecting everything else in the image and that will destroy the rest of the image. The remove background image tool in Adobe Express saved me hours of tedious editing, effortlessly removing backgrounds and refining my images with just a few. While you cannot replace, remove, or radically change the background in LR you can take advantage of the Adjustment Brush tool. Now you need to use a Lightroom adjustment brush tool to remove the shadows which are available on your photos. You could find the Brush tool option at the top. Detailed Guide to Remove Image Background · Step 1: Launch the HitPaw Photo Object Remover and click on the Remove Background icon. · Step 2: When you upload. If you want to get rid of shadows in Lightroom, start by making global adjustments to your image, and using sliders is the easiest way to do it. on the effect control panel, locate the effect and use the eye dropper tool the select the color you want to remove. once that is done, you'll. Get started · Sign up to orient-interior.ru to create a Kaleido account. · Go to Zapier to sign up for a new account, or sign in to your existing one. · On Zapier, connect. Import your image into Lightroom and navigate to the Develop module. · Locate the Spot Removal tool in the toolbar. · Click on Content-Aware.

Use “[“ or “]” key to adjust the brush size. Once you release the mouse after painting, the branch will be magically gone (removed from the background). A. Erase – You can use the Adjustment Brush to paint on a mask. When doing so, you will see a “+” symbol at the center of the brush. Clicking the Erase option will. Step 1: Open the image in Lightroom · Step 2: Select Spot Removal · Step 3: Apply heal on the object · Step 4: Apply the Clone Tool · Step 5: Remove Shadow &. Graphic elements, and a person smiling in the background. Mute the audio in your video clip. Select the Mute option if you wish to remove the audio from your. If it's a full white background, you may be able to achieve it by selecting subject > invert (yes, I know you can select the background, but. While you cannot replace, remove, or radically change the background in LR you can take advantage of the Adjustment Brush tool. Have you ever wanted to delete a photo from inside of Lightroom, but accidentally "remove" the photo instead? Background For Portraits. Feb 7, The principle is that you light the subject against a pure green background and then remove the green in software (or video hardware) and replace it with an. Remove to erase background distractions, blemishes or shiny skin. Travel Photos. Presets and filters that enhance the sky in one tap and Remove tools to clean. background bts business critique dog photography editing full edits gifts horse how to indoor photography interview kit reviews lead removal lenses lightroom. We are going to reveal a trick to remove the background from any photos and replace the background with white color in Lightroom. The background cannot be removed using Lightroom. But, by changing the exposure, background color can be altered to black or white using healing brush tools. The heal tool functions kind of like an eraser in Lightroom. Especially with the newest heal tool, Content-Aware Remove, you'll be able to take out distracting. In the Layers panel, double-click on the Background layer. A New Layer dialog box will open and ask you to rename the layer. You can leave this as Layer 0. Just click on each spot with the spot removal tool that you've already selected, and they'll be removed automatically. Lightroom will choose a similar area to. If some of the background area selected includes parts of the image that you don't want to darken you can use any of the masks in the existing mask to erase. Find the Sharpness slider on the panel and move it towards the left until you reach the desired amount of blur. 3. Lightroom Background Blur: Graduated Filters. Create product and portrait pictures using only your phone and our AI photo editing tools. Remove background, change background and showcase products. In the background, we have these very busy flowers and this bright branch. We can remove those in Lightroom without the need for Photoshop with the photo. So, press the alt/option button, click and drag around the edits, and release (the mouse button) to delete them. Now, if you're not getting the desired result.

Growing A Successful Business

In this post, we’ll share 5 actionable tips for growing a successful small business, from mastering your mindset to optimising your operations and more. How to Grow a Successful Business · 1. Get Organized · 2. Keep Detailed Records · 3. Analyze Your Competition · 4. Understand the Risks and Rewards · 5. Be Creative. Growing your business doesn't happen overnight, rather it's the result of many, many months – sometimes years – of nurturing that compound. orient-interior.ru for growing your startup into a successful business[Original Blog] · 1. Have a clear vision for your business. · 2. focus on your core competencies. · 3. 1. Identify your mission. Every successful business has a mission. Whether it's providing a unique service, offering budget-friendly products, or championing. Recipe for a Successful Business: Growing success! · Think Differently. As a small business owner, your main ambition is to grow your company. · Believe and. 1. Identify your mission. Every successful business has a mission. Whether it's providing a unique service, offering budget-friendly products, or championing. If you are successful in your existing market, you will reach a point where your sales and marketing expenses produce diminishing returns. That's the time when. We've compiled some expert advice on how to grow a small business that can help you achieve success regardless of the market you're in. In this post, we’ll share 5 actionable tips for growing a successful small business, from mastering your mindset to optimising your operations and more. How to Grow a Successful Business · 1. Get Organized · 2. Keep Detailed Records · 3. Analyze Your Competition · 4. Understand the Risks and Rewards · 5. Be Creative. Growing your business doesn't happen overnight, rather it's the result of many, many months – sometimes years – of nurturing that compound. orient-interior.ru for growing your startup into a successful business[Original Blog] · 1. Have a clear vision for your business. · 2. focus on your core competencies. · 3. 1. Identify your mission. Every successful business has a mission. Whether it's providing a unique service, offering budget-friendly products, or championing. Recipe for a Successful Business: Growing success! · Think Differently. As a small business owner, your main ambition is to grow your company. · Believe and. 1. Identify your mission. Every successful business has a mission. Whether it's providing a unique service, offering budget-friendly products, or championing. If you are successful in your existing market, you will reach a point where your sales and marketing expenses produce diminishing returns. That's the time when. We've compiled some expert advice on how to grow a small business that can help you achieve success regardless of the market you're in.

Don't overlook marketing. You need content to grow your company and get your brand recognition out in the business community. If 94% of successful business. The basic theory is you need a great product/service that gives you an edge above others. Your business model should be scalable and profitable. How to grow your business quickly · 1. Hire the right people. · 2. Focus on established revenue sources. · 3. Reduce your risks. · 4. Be adaptable. · 5. Focus on the. Growing your business doesn't happen overnight, rather it's the result of many, many months – sometimes years – of nurturing that compound. 10 keys to success in business · 1. Successful business starts with a plan · 2. Stay organized · 3. Keep detailed records · 4. Know your audience · 5. Stay flexible. How to Become a Successful Freelancer · Why Are Companies That Lose Money Still So Successful? Partner Center. Harvard Business Review Home · Start my. There is no formula for instant success. When you start your small-scale business, your main goal is to establish your brand and start growing. Growth is an. I was thinking about how long it takes to grow a successful business. In my work now as a VC, it takes about years to get a seed stage. Tips For Growing a Successful Business · Hire The Right People · Always Look To Improve · Provide a Better Service / Product Than Your Competitors · Stay Focused. What are your end goals? How will you finance your startup costs? These questions can be answered in a well-written business plan. Fledgling business owners can. This comprehensive resource provides current and prospective small-business owners valuable insight and guidance for not only starting a business, but also. Figure out what areas of your business you can grow, recruit a solid team, plan for risk, work on your leadership skills and dive deep into your numbers to see. There is no one way to grow a business. You may want to expand your service area, form business partnerships, launch new products in existing markets, diversify. Increase Your Number of Qualified Leads · Convert Prospects Into Buyers · Identify Your Challenges · Increase Individual Sales · Grow Your Profit Margin · Lower The. This article is designed to equip you with valuable insights and practical tips to kick-start your journey to success. I will share advice about the main types of business growth strategies, how to grow your business when money is limited, and how to design the growth strategy. The following are the 10 Essential Strategies for Building and Growing a Successful Business · Embrace Modern Marketing Marvels: · Organization & People: The. Being successful as a business owner requires more than coming up with a brilliant idea and working hard. You need to learn how to manage and grow your. 1. Start with a Good Business Idea · 2. Conduct Research About Your Business Idea · 3. Write a Business Plan · 4. Make Your New Business Official · 5. Know Your. 4. Bigger/Better · Alert: They've always got their antennae out, tuned in to your vision for the company, and they anticipate the next step to take. · Curious.

Best Way To Create Passive Income

1. Dividend stocks and funds. Dividends are payments that companies make to their investors as a way of passing along their profits. · 2. Bonds and bond funds · 3. How To Choose The Right Dividend Stocks. Look for companies with a history of consistent dividend payments; Research dividend yield and payout ratios; Diversify. Content creation · E-commerce · Digital products · Create video courses for · Rent out your spare room · Do blogging · Design custom · Advertising on. 22 more passive income opportunities for college students · Make online videos · Food delivery services · Peer-to-peer lending · Create a blog · Start an e-commerce. You can generate passive income with affiliate marketing, Amazon affiliate is popular for passive income opportunity. Affiliate marketing can be automated and. The key to how to make passive income is to match your initial investment of time and energy to your risk tolerance level. (And of course, always do your. To generate passive income in today's market, I recommend focusing on digital assets. Creating and uploading icons, elements, and other digital resources to. 11 Best Passive Income Ideas · 1. Dividend investing. As a dividend investor, you purchase stocks that share earnings with shareholders by way of dividend. Top sources of passive income for Canadians looking to earn more · DIVIDEND STOCKS · REAL ESTATE INVESTMENT TRUSTS (REITs) · BONDS AND FIXED-INCOME INVESTMENTS. 1. Dividend stocks and funds. Dividends are payments that companies make to their investors as a way of passing along their profits. · 2. Bonds and bond funds · 3. How To Choose The Right Dividend Stocks. Look for companies with a history of consistent dividend payments; Research dividend yield and payout ratios; Diversify. Content creation · E-commerce · Digital products · Create video courses for · Rent out your spare room · Do blogging · Design custom · Advertising on. 22 more passive income opportunities for college students · Make online videos · Food delivery services · Peer-to-peer lending · Create a blog · Start an e-commerce. You can generate passive income with affiliate marketing, Amazon affiliate is popular for passive income opportunity. Affiliate marketing can be automated and. The key to how to make passive income is to match your initial investment of time and energy to your risk tolerance level. (And of course, always do your. To generate passive income in today's market, I recommend focusing on digital assets. Creating and uploading icons, elements, and other digital resources to. 11 Best Passive Income Ideas · 1. Dividend investing. As a dividend investor, you purchase stocks that share earnings with shareholders by way of dividend. Top sources of passive income for Canadians looking to earn more · DIVIDEND STOCKS · REAL ESTATE INVESTMENT TRUSTS (REITs) · BONDS AND FIXED-INCOME INVESTMENTS.

Rental properties and stock market investments are two of the most popular ways to generate passive income due to their potential for high returns. How do I. Dividend paying stocks? Real estate is not something I am looking at right now. Also looking for a coach in this area. Someone to hold me accountable and help. Real estate investment trusts (REITs) that trade publicly on stock market exchanges are traditionally the easiest and lowest-cost way to invest in real estate. The tech field offers some of the best ways to earn passive income. Tech professionals can make extra money with minimal routine work by developing an app. 25 Ways To Make Passive Income in · 1. Rent All or Part of Your Property · 2. Store Stuff for People · 3. Rent Out Items for People to Use · 4. Bonds and Bond. One of the easiest ways to get exposure to dividend stocks is to buy ETFs like DVY, VYM, and NOBL or index funds. Alternatively, you can DIY and use Empower's. If you haven't considered creating an online program, it's definitely worth thinking about. Online courses are a wonderful way to share your knowledge with your. An alternative way to earn passive income through real estate is by investing in a real estate investment trust (REIT). REITs "own and manage income-producing. Make it your mission to always contribute X amount every month and consistently increase the savings amount by a percentage or several until it hurts. Pause for. Passive income ideas · 1. Earn royalties on your photos or artwork · 2. Design printables or templates · 3. Create a website or blog · 4. Rent out a spare room or. There are many ways to earn passive income. You can earn it by investing, renting various assets out to others, leveraging advertising opportunities. People can create passive income streams by investing, selling online products, writing a blog, and more. Strategy #1: start a blog · Starting a blog is by far the best thing you can do to build passive income without any capital. · Google Adsense is the most. One of the best passive income ideas is selling a course. Everyone has something to teach, and you don't have to spend much money upfront. Online courses are. Investing in rental properties is an excellent way to generate a steady passive income. As a property owner, you stand to gain from monthly rental payments and. Stocks, bonds, real estate, mutual funds, ETFs, alternatives can all generate passive income. Each has its own risk and return profile. Your choice should align. 7 PASSIVE INCOME IDEAS (easily make $/day) · #1 – Membership site · #2 – Royalties · #3 – YouTube · #4 – Podcast or blog · #5 – Digital products · #6 – Affiliate. 22 more passive income opportunities for college students · Make online videos · Food delivery services · Peer-to-peer lending · Create a blog · Start an e-commerce. Investing in a local business is one of the best ways to create stable passive income streams. It's worth considering if you're serious about building wealth. Create a side hustle. Another way to generate income is through a part-time job or side hustle. Examples include: Affiliate marketing. Retirement.

How Many Black Owned Banks Are There

Today there are just 18 of these vital community anchors. Black-owned banks deploy resources that uniquely address the needs of Black-owned businesses. Did you know, as of the latest information available, that only 23 out of 5, insured financial institutions in the United States are owned and operated. At its peak there were over 30, banks in the United States, while today there are less than 5, With this history in mind, and for so many. OCC-Supervised Minority Depository Institutions ; BancCentral, NA, Women Owned, () ; Bank of Whittier NA, Asian or Pacific Islander American Owned, . Many have either been acquired or have simply gone out of business. We've compiled the most recent and up to date list of the banks that are still Black owned. banks and savings associations may qualify for MDI status. Ownership must be by U.S. citizens or permanent legal U.S. residents to be counted in determining. A clickable list of over Black-owned banks and credit unions. Collection include short, captivating, informative videos plus an interactive desktop map. FDIC records show the nation's total minority-owned depository institutions, or MDIs, grew their combined assets more than 15% last year, from about $ They have total assets of more than $ billion. They provide loans particularly to small businesses, churches, and other community organizations in the black. Today there are just 18 of these vital community anchors. Black-owned banks deploy resources that uniquely address the needs of Black-owned businesses. Did you know, as of the latest information available, that only 23 out of 5, insured financial institutions in the United States are owned and operated. At its peak there were over 30, banks in the United States, while today there are less than 5, With this history in mind, and for so many. OCC-Supervised Minority Depository Institutions ; BancCentral, NA, Women Owned, () ; Bank of Whittier NA, Asian or Pacific Islander American Owned, . Many have either been acquired or have simply gone out of business. We've compiled the most recent and up to date list of the banks that are still Black owned. banks and savings associations may qualify for MDI status. Ownership must be by U.S. citizens or permanent legal U.S. residents to be counted in determining. A clickable list of over Black-owned banks and credit unions. Collection include short, captivating, informative videos plus an interactive desktop map. FDIC records show the nation's total minority-owned depository institutions, or MDIs, grew their combined assets more than 15% last year, from about $ They have total assets of more than $ billion. They provide loans particularly to small businesses, churches, and other community organizations in the black.

By , there were more than 50 Black-owned banks across the United States. Today there are just 18 of these vital community anchors left. Black-owned banks. Navigate our interactive maps to find Black-owned financial institutions near you. In addition, our maps of banking deserts show the locations of Black-owned. many other banks would. Columbia Savings & Loan is the oldest, and only, African American owned bank in the state of Wisconsin. When the Halyards started the. black businesses, capital that white-owned banks were unwilling to lend. The community proudly deposited its money in Capital Savings Bank. The public's. Did you know, as of the latest information available, that only 23 out of 5, insured financial institutions in the United States are owned and operated. “We are now pleased to announce a partnership with the presidents of the nineteen (19) Black banks in the United States, with the goal of increasing Black. figures show there are 20 Black banks in America as of the first quarter of In contrast, there were a robust 48 in Conversely, since the death of. African American Owned Banks (AAOBs) are in 14 states and territories. · There has not been an African American Owned Bank (AAOB) started in 22 years. · Alabama. Library of Congress Prints and Photographs Division. African Americans established their own banks and insurance companies in response to discriminatory. businesses – at a time when not many other banks would. Columbia Savings & Loan is the oldest, and only, African American owned bank in the state of Wisconsin. Between and , Black owned banks were formed to help the Black community overcome challenges and serve as an important source of credit while also. There are FDIC-recognized minority banks serving minority and low-to-moderate-income communities. Although most minority banks operate in metropolitan areas. Financial stability and reinvestment in the Black community are crucial steps toward achieving orient-interior.ru you know there are over 35 Black owned banks and. Optus Bank is one of 17 Black Owned banks in the US (as of ) and the only Black owned bank in South Carolina. Best Black-Owned Banks for Small Businesses · 1. Broadway Federal Bank · 2. Carver Federal Savings Bank · 3. Citizens Trust Bank · 4. First Independence Bank · 5. It turns out that there are already over 35 African-American owned banks and credit unions in the United States where you can put your money. Black-owned banks are just one small step towards improving the situation There could be many reasons and variables that have affected these failures. Over five decades later, Liberty Bank and Trust has over $1 billion in assets and branches in 11 states making it the largest black or African American owned. What Is the Largest Black-Owned Bank in America? · OneUnited Bank · Liberty Bank · Carver Federal Savings Bank. In , Riverside National Bank was acquired by Bay Bancshares and renamed Unity National Bank of Houston. In , local African American businessmen acquired.

Qqqq Etfs

In this article, we explain how the QQQ ETF works and then consider the risks and rewards associated with trading the QQQ. Cathie Wood's ETF Is Beating the Nasdaq This Is a Better Bet. Jan. 19, p.m. ET. A Tech-Heavy Index Is Hitting Its. This ETF offers exposure to one of the world's most widely-followed equity benchmarks, the NASDAQ, and has become one of the most popular exchange-traded. Snapshot. ** QQQ has a higher expense ratio than QQQM by %. This can indicate that it's more expensive to invest in QQQ than QQQM. QQQ targets investing. ETFs™, Defined Protection ETFs™, and Accelerated ETFs. AJAN, TJUL, SFLR The Innovator Hedged Nasdaq® ETF (QHDG) offers exposure to the Nasdaq. Find similar ETFs to (QQQ) ETF - Compare other ETFs that are similar to QQQ in performance, different metrics, and ratios. Find the latest Invesco QQQ Trust (QQQ) stock quote, history, news and other vital information to help you with your stock trading and investing. Performance charts for Invesco QQQ Trust Series 1 (QQQ - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. What Is the QQQ Stock Price Today? The QQQ stock price today is What Stock Exchange Is QQQ Traded On? QQQ is listed and trades on the NASDAQ stock. In this article, we explain how the QQQ ETF works and then consider the risks and rewards associated with trading the QQQ. Cathie Wood's ETF Is Beating the Nasdaq This Is a Better Bet. Jan. 19, p.m. ET. A Tech-Heavy Index Is Hitting Its. This ETF offers exposure to one of the world's most widely-followed equity benchmarks, the NASDAQ, and has become one of the most popular exchange-traded. Snapshot. ** QQQ has a higher expense ratio than QQQM by %. This can indicate that it's more expensive to invest in QQQ than QQQM. QQQ targets investing. ETFs™, Defined Protection ETFs™, and Accelerated ETFs. AJAN, TJUL, SFLR The Innovator Hedged Nasdaq® ETF (QHDG) offers exposure to the Nasdaq. Find similar ETFs to (QQQ) ETF - Compare other ETFs that are similar to QQQ in performance, different metrics, and ratios. Find the latest Invesco QQQ Trust (QQQ) stock quote, history, news and other vital information to help you with your stock trading and investing. Performance charts for Invesco QQQ Trust Series 1 (QQQ - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. What Is the QQQ Stock Price Today? The QQQ stock price today is What Stock Exchange Is QQQ Traded On? QQQ is listed and trades on the NASDAQ stock.

Get Invesco QQQ Trust (QQQ:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The QQQ's impressive track record, fueled by its focus on mega-cap tech stocks, has delivered a compound annual growth rate (CAGR) of % over the past. Real-time Price Updates for Nasdaq QQQ Invesco ETF (QQQ-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. QQQ and other ETFs, options, and stocks. Sign up. About QQQ. QQQ tracks a modified-market-cap-weighted index of NASDAQ-listed stocks. The listed name for. Learn everything about Invesco QQQ Trust (QQQ). News, analyses, holdings, benchmarks, and quotes. Discover QQQ stock price history and comprehensive historical data for the Invesco QQQ Trust ETF, including closing prices, opening values, daily highs and. U.S. News evaluated Large Growth ETFs and 34 make our Best Fit list. Our list highlights the best passively managed funds for long-term investors. Rankings. QQQY, the first put-write ETF using daily options (0DTE) to seek enhanced income for investors. Paid Monthly. Get Invesco QQQ Trust (QQQ:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. A high-level overview of Invesco QQQ Trust ETF (QQQ) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. U.S. News evaluated Large Growth ETFs and 34 make our Best Fit list. Our list highlights the best passively managed funds for long-term investors. Rankings. Explore QQQ for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Top Nasdaq ETFs. The Nasdaq index. The Nasdaq index tracks the largest stocks listed on the Nasdaq stock exchange. The selected companies are. Invesco QQQ ETF (Invesco QQQ ETF): stock price, performance, provider, sustainability, sectors, trading info. How Does QQQ Work? QQQ is a popular ETF designed to track the Nasdaq Index. In an attempt to mirror that index's performance, the ETF invests all its assets. This ProShares ETF seeks daily investment results that correspond, before fees and expenses, to 2x the daily performance of its underlying benchmark (the “Daily. 21 ETFs ; QQQTDefiance Nasdaq Target Income ETF. Equity: U.S. - Large Cap ; DWUSAdvisorShares Dorsey Wright FSM US Core ETF. Equity: U.S. - Large Cap ; MSTQLHA. Exchange-Traded Funds. Page last updated: AM ET Refresh. Invesco QQQ Trust QQQ:NASDAQ. Last Price, Today's Change, Bid/Size, Ask/Size. Invesco QQQ Trust (QQQ) Holdings - View complete (QQQ) ETF holdings for better informed ETF trading. One of the most popular index ETFs for tracking the Nasdaq is currently the Invesco QQQ Trust Series 1 (QQQ). With an inception date of March 10, , QQQ.

How To Process Credit Card Payment

Card details and purchase amount must first be verified and approved by the issuing bank. · The issuing bank checks the validity of the credit or debit card used. Credit card processing is what allows businesses to securely accept payments made via credit, debit, gift, and even loyalty cards. This article covers how to accept credit card payments and the methods you can use to get paid in person, online, and remotely. We will explore some of the cheapest ways to accept credit card payments, helping businesses expand their payment options while keeping costs to a minimum. The four steps you can take to start accepting credit card payments ASAP: getting your POS, payment processor, merchant account, and payment hardware. Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at. What is credit card processing? How it does it work? Learn how credit card processing fees are structured and how to optimize your business costs. Read on for information about how we got here, how a credit card is processed, and industry/legal requirements your business must follow while taking credit. Credit card processing in 8 simple steps · 1. Making the purchase · 2. Entering the transaction · 3. Transmitting the data · 4. Authorizing the transaction · 5. Card details and purchase amount must first be verified and approved by the issuing bank. · The issuing bank checks the validity of the credit or debit card used. Credit card processing is what allows businesses to securely accept payments made via credit, debit, gift, and even loyalty cards. This article covers how to accept credit card payments and the methods you can use to get paid in person, online, and remotely. We will explore some of the cheapest ways to accept credit card payments, helping businesses expand their payment options while keeping costs to a minimum. The four steps you can take to start accepting credit card payments ASAP: getting your POS, payment processor, merchant account, and payment hardware. Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at. What is credit card processing? How it does it work? Learn how credit card processing fees are structured and how to optimize your business costs. Read on for information about how we got here, how a credit card is processed, and industry/legal requirements your business must follow while taking credit. Credit card processing in 8 simple steps · 1. Making the purchase · 2. Entering the transaction · 3. Transmitting the data · 4. Authorizing the transaction · 5.

Take advantage of credit cards and short-term financing to drive your business growth. Save time and money with streamlined payment processing. The best way to accept credit card payments depends on your business's needs. The simplest solution is to use a payment service provider that gives you multiple. A mobile credit card reader allows you to accept debit and credit card payments via a mobile device, unlike conventional credit card terminals. How long does a credit card payment take to process? Generally, it takes two to four business days for payments to be processed from the customer's card. Wondering how the credit card payment process works? Read this guide and learn how card payments get authorized, authenticated, and settled. To sign up for Chase Payment Solutions, reach out to a Payments Advisor at or fill out this short form. The processing company then sends the information to the credit card issuer, who verifies the identity of the cardholder, and then decides whether or not to. Here's a practical guide that answers the most common questions small business owners have about credit card processing. In the transaction process, a credit card network receives the credit card payment details from the acquiring processor. It forwards the payment authorization. How to Accept Credit Card Payments: A Small Business Guide Small businesses can accept credit card payments by using an online merchant gateway like Stripe or. Settlement · The merchant sends their batched approved authorizations to the payment processor. · The payment processor sends the authorizations to the card. A merchant bank establishes and maintains merchant accounts. Merchant banks allow merchants to accept deposits from credit and debit card payments. Payment. Making Payments · 1. Online · 2. ATM Credit Card Payments · 3. Pay by phone · 4. Drop off payment · 5. Mail payment. This guide will walk you through the process, giving you all the information you need to find the right match for your business. Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at. Accept one-time, recurring, and mobile credit card payments with PaySimple - software that keeps your small business moving. The Square Reader for contactless and chip accepts EMV chip cards and NFC payments. What is credit card processing? Taking a credit card payment may seem simple. How to accept credit cards online · Easy integration: Incorporating the online payment options into your online store or website should be straightforward. · E-. Which credit cards do you accept? American Express, Discover Network, MasterCard, and Visa cards are accepted. Is there. If you want to offer this option to your customers, you'll need a card reader with an EMV chip card payment terminal. Note that if you accept in-person payments.